wake county nc tax deed sales

Sales usually occur once a month. Notices of sale are published in the newspaper once a week for two weeks posted at the Courthouse for at least 20 days as well as being posted on the Durham County Tax Administration Website.

Foreclosure Listings North Carolina The Kania Law Firm

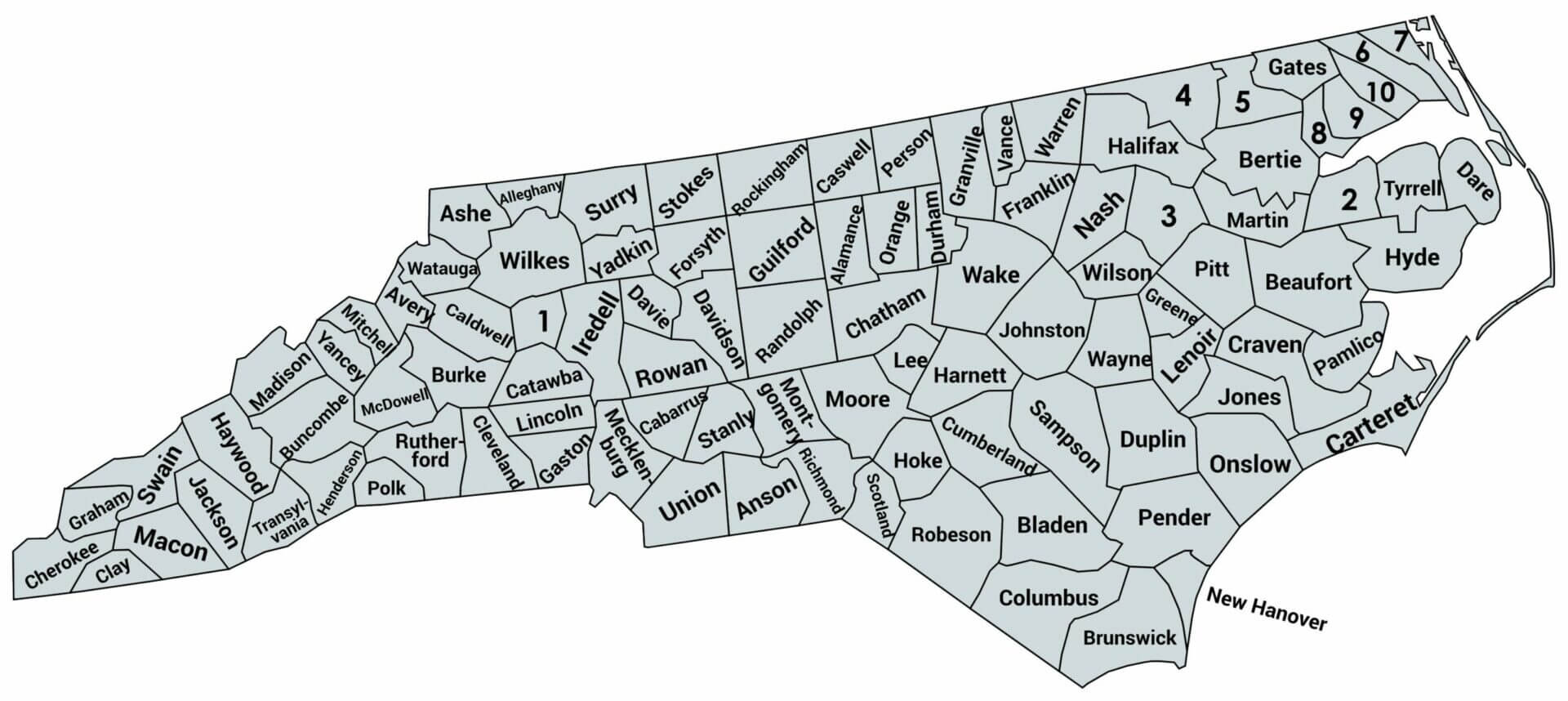

87 rows 100 County Tax DepartmentsTax Department OfficesTax OfficesTax Collections Offices and.

. Ownership sale information and property detail for all Wake County real estate parcels is available for download. Data Files Statistics Reports Download property data and tax bill files. Easy commute to Wendell Clayton Raleigh or Durha.

Has impacted many state nexus laws and sales tax collection requirements. Yearly median tax in Wake County. In North Carolina the County Tax Collector will sell Tax Deeds to winning bidders at the Wake County Tax Deeds sale.

Generally the minimum bid at an Wake County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property. Main Street Wake Forest. According to state law the sale of North Carolina Tax Deeds are final and the winning.

The sale vests in the purchaser all right title and interest of Wake County in the property including all delinquent taxes which have become a lien since issuance of North Carolina tax deed. What is the Grande Ronde Cellars. Search All of the Most Up-to-Date Foreclosure Listings Available Near You.

3 beds 25 baths 2457 sq. The North Carolina state sales tax rate is currently. Once a judgment of sale is entered the property is scheduled for sale at the Durham County Judicial Building.

Wake County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Wake County North Carolina. Posted on December 23 2020 by December 23 2020 by. Comprehensive listings of foreclosures short sales auction homes land bank deals.

342 Wake County Line Rd Zebulon NC 27597 489900 MLS 2441295 Country living at its finest. This action is required by North Carolina General Statutes. This is the total of state and county sales tax rates.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. Wake County NC Sales Tax Rate. 081 of home value.

August 5 2021 Date Judgment Filed with Courts. The current total local sales tax rate in Wake County NC is 7250. These records can include Wake County property tax assessments and assessment challenges appraisals and income taxes.

6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina. Locates the deed to the property and determines possible liens or. Property owners as of January 1 are required to report any new buildings additions improvements andor deletions that occurred during.

Ad Register for Instant Access to Our Database of Nationwide Foreclosure Listings. Ad Compare North Carolina foreclosed homes by neighborhood schools size more. Everyone is happy Wake County North Carolina recovers lost tax revenue the purchaser acquires title to the tax delinquent property free and clear of all liens including mortgages created prior.

933 Jones Dairy Road Wake Forest Date of First Action. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Wake County NC at tax lien auctions or online distressed asset sales. Find Wake County Tax Records.

Sales are conducted on the courthouse steps at 200 North Grove St Hendersonville NC 28792. Date of Sale. The Wake County sales tax rate is.

Tax deed sales wake county nc. NC Sales Tax Rate. Wake County collects on average 081 of a propertys assessed fair market value as property tax.

To view instructions on retrieving a full listing of real estate billing and delinquent files please visit our page for Real Estate Tax Bill Payment Files. November 5 2021 Date of Sale. Wake County has one of the highest median property taxes in the United States and is ranked.

Ad Find Tax Foreclosures Under Market Value in North Carolina. 2 from Download all north carolina sales tax rates by zip code the wake county north carolina sales tax is 725 consisting of 475 north carolina state sales tax and 250 wake county local sales taxesthe local sales tax consists of a 200. The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300.

A tax lien attaches to real estate on January 1 and remains in place until all taxes on the property are paid in full. Real estate in Wake County is permanently listed and does not require an annual listing. Use the Wake County Tax Portal to view property details research comparable sales and to file a real estate appeal online.

The 2018 United States Supreme Court decision in South Dakota v. Commencement of any of these actions will result in additional costs andor fees being added to the unpaid bills. The Henderson County Tax Collector is authorized to foreclose on real property for which delinquent property taxes remain unpaid.

Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. The December 2020 total local sales tax rate was also 7250. To review the rules in North Carolina visit our state-by-state guide.

Wake County NC currently has 950 tax liens available as of March 13. The full Wake County real estate file is available in the following formats. The data files are refreshed daily and reflect property values as of the most recent countywide reappraisal.

How To Find Tax Delinquent Properties In Your Area Rethority

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

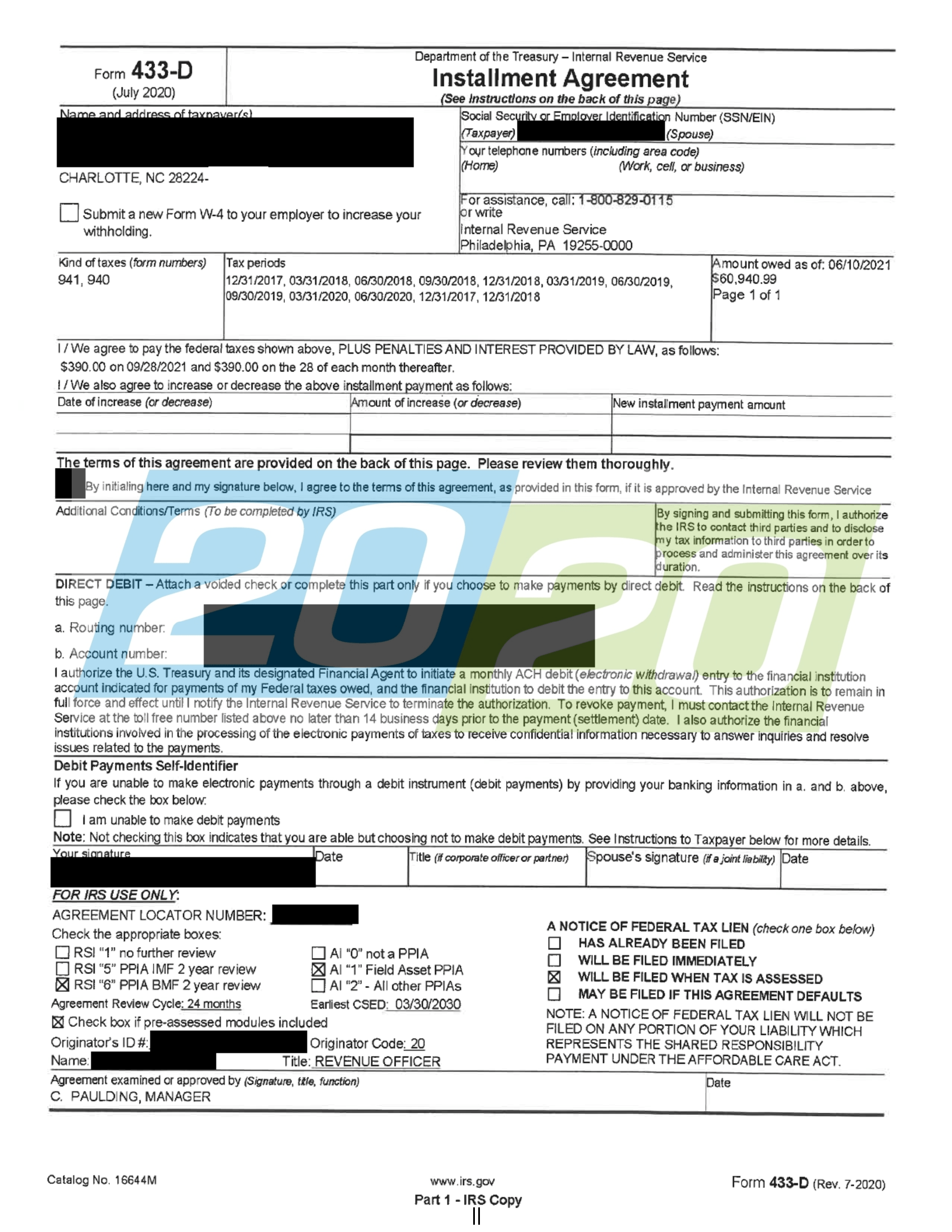

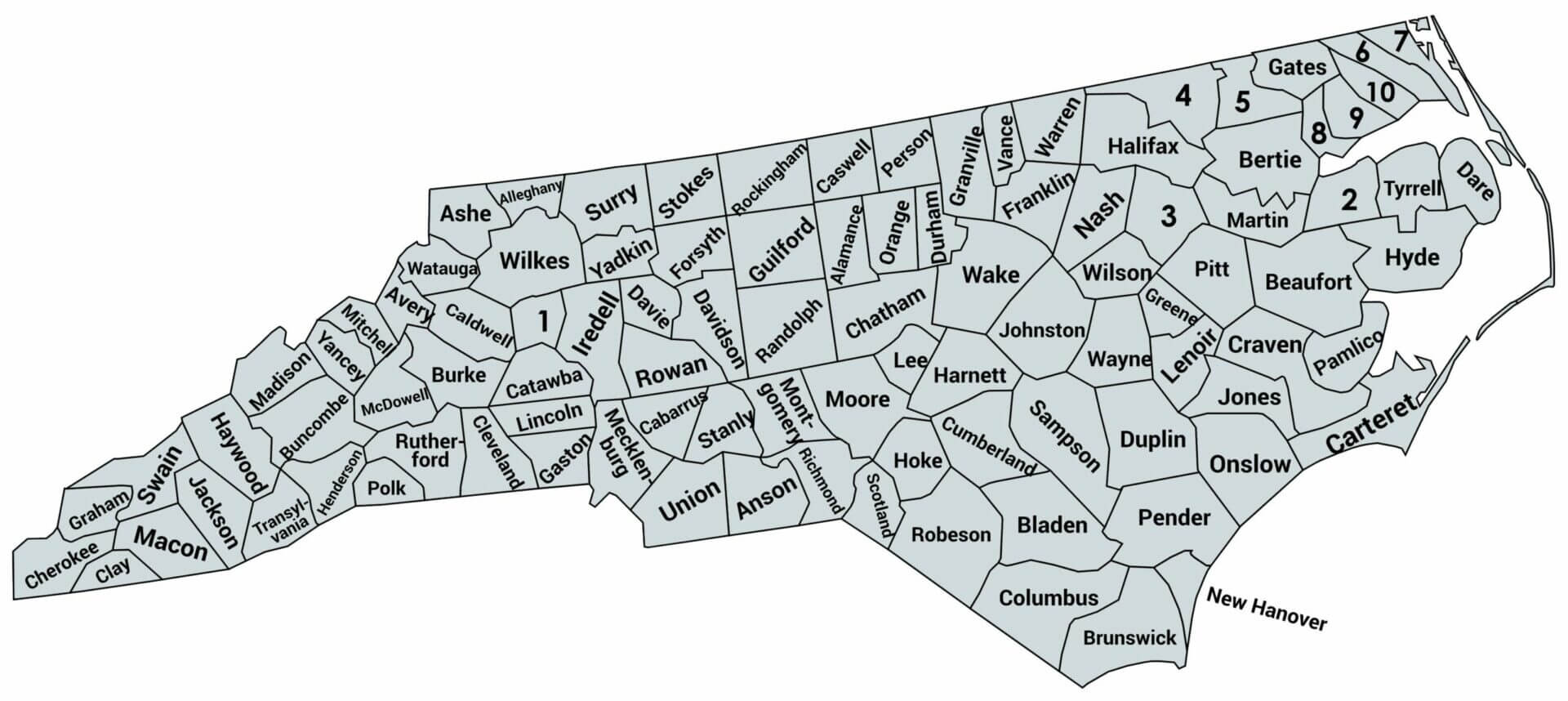

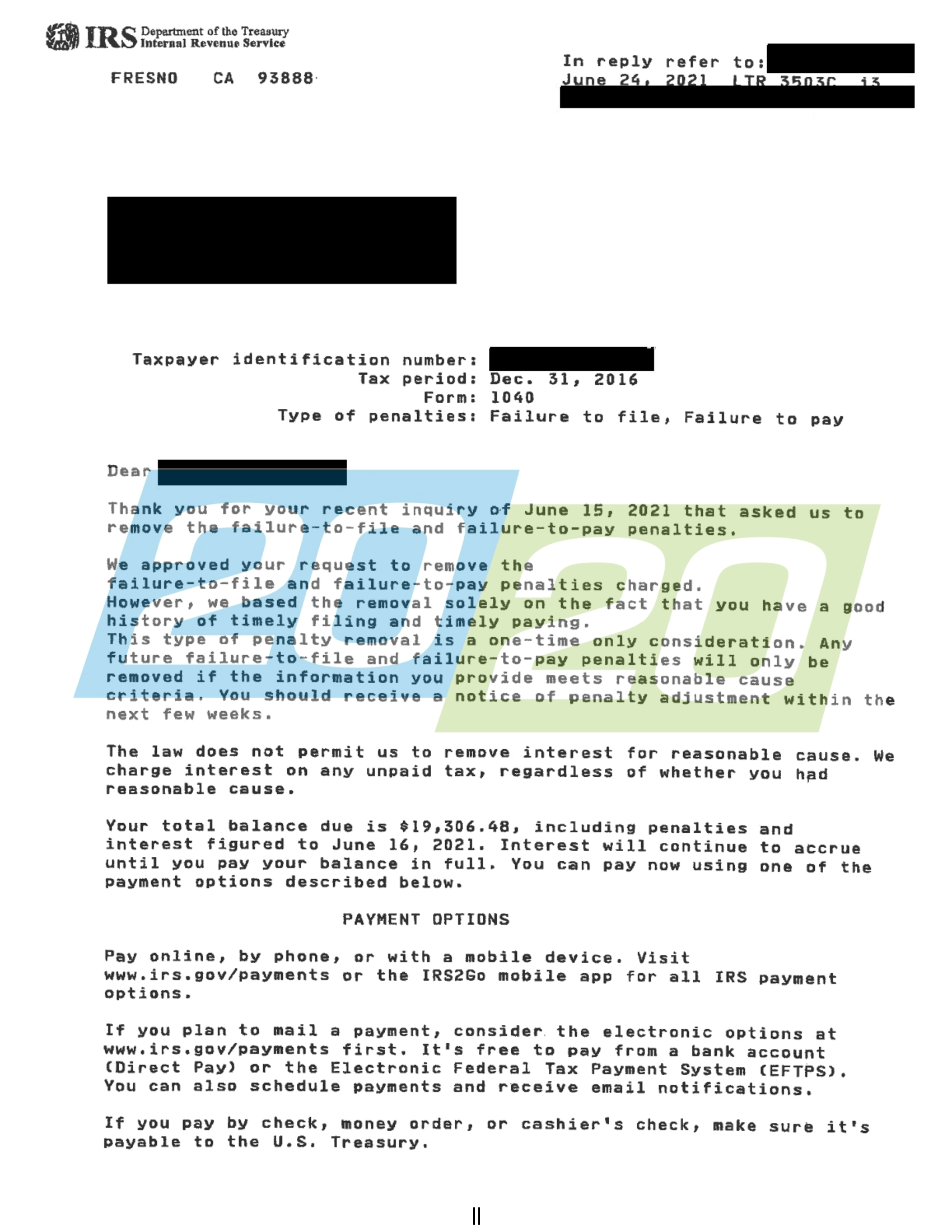

Tax Burdens Lifted In North Carolina 20 20 Tax Resolution

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Definition Of Tax Lien Auctions Essay Help Writing Sites Good Essay

Tax Burdens Lifted In North Carolina 20 20 Tax Resolution

Open House Sunday 2 4 Cathedral Ceiling Open House Home Warranty

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

How To Find Tax Delinquent Properties In Your Area Rethority

Tax Burdens Lifted In North Carolina 20 20 Tax Resolution

Vincent Allen Project Archives The Old House Life Old House House Old Things

Foreclosures Tax Department Tax Department North Carolina

Foreclosures Tax Department Tax Department North Carolina

How To Find Tax Delinquent Properties In Your Area Rethority

Tax Burdens Lifted In North Carolina 20 20 Tax Resolution

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Tax Burdens Lifted In North Carolina 20 20 Tax Resolution

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas